Meet the Team

-

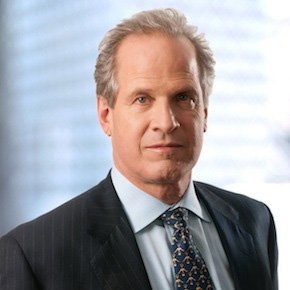

Doug is the Chief Investment Officer and Managing Partner of Westport Alpha Group (WAG). Prior to founding WAG, he founded Katahdin Capital, a Millennium Platform Company where he managed $800 million in a multi-strategy, multi-sector hedge fund. Prior to that, he worked at Citadel LLC where he managed $1 billion and was a two time top Alpha award winner. Prior to the buy-side, he spent seven years at entrepreneurial Investment Banks: DRCO (now TD Cowen) and FBR Capital Markets.

-

Prior to joining Westport Alpha Group (WAG), Scott was instrumental in building HRI Properties, a vertically integrated Real Estate company. Scott grew with the company over nearly two decades of service. He helped build the company from $10 million in AUM to nearly $ 1 billion. He executed numerous capital raises with various private equity partners. He was a key member of the investment committee that purchased 17 hotels and 14 multi-family apartment buildings across the U.S..

-

Daniel has experience working with large Private Equity and Real Estate funds on branding and marketing their projects to investors and the community.

Daniel works with founders, CEOs and empowered leaders who are looking to deliver on their objectives and ultimately transform their business.

Their great and never-ending challenge is to overcome business complexity—the pressure, unknowns, lack of resources, politics, decision-fatigue, bureaucracy, and so on.

As a facilitator, design practitioner, and strategic thinker, I have dedicated my career to help leaders cut through that complexity with new approaches to simplify business, achieve results, and bring joy back into work.

As an independent consultant, Daniel Vogelzang has worked with Fortune 500 corporations, major consumer brands, start-ups, and non-profit organizations. Daniel has demonstrated an ability to effectively reach objectives, drive value and create growth. Previously, Daniel was a co-founder and partner at Soldier Design, a boutique design and branding studio.

-

James serves as legal adviser to investors, entrepreneurs, investment advisers and investment bankers as they fund or invest in new companies, grow established privatecompanies, raise funds privately or go public,and embark on complex mergers and acquisitions.

Clients look to James to help them organize companies, launch angel and venture capital private financings, form hedge funds and private equity funds, and make private investments in public entities (PIPEs). James also assists with initial and follow on public offerings, public company compliance, bankruptcy and other reorganizations, mergers and acquisitions, licensing, software development, executive compensation and general corporate matters.

His recent merger and acquisition work includes public company mergers, purchases and sales of private companies and purchases and sales of assets and businesses in bankruptcy. In addition, James and his colleagues counsel private investment companies on private placements, securities law compliance and private investment.

James has acted as counsel in international transactions, including the sale of a Spanish company operating in seven Latin American companies, organization of off-shore private equity funds and private equity investing in China, Canada, Israel, New Zealand, Pakistan and Georgia.

James has spoken to client and industry groups, including the Practicing Law Institute, on various topics including PIPEs, issuance of equity in bankruptcy, down rounds, limited liability companies, equity kickers for lenders and legal ethics

-

Morpheus Solutions provides businesses with investment capital and strategic advisory expertise to scale their business.

Prior to Morpheus Solutions, Gary was the Chairman and CEO of Carbo Ceramics (NYSE: CRR), a technology focused oilfield service company that focused on improving their customers returns.

In Gary’s words, “Raised in the beautiful state of Montana, I feel so fortunate to have grown up on a farm and ranch, where I learned a lot about people, common sense, and the value of working hard. My life is driven by my positive attitude.

I am a high energy individual with strengths in leadership, global business operations, identifying and executing different business models, marketing strategy, and technology. My leadership experience is global, covering numerous cultures and nationalities, while functioning in several senior management positions. My unique strengths are a “can-do” attitude toward all challenges, and a broad-based intellectual curiosity about technology trends and how to apply them to business for growth and profitability.

My career path has been very fun and filled with learning. 21 years in a very large public company managing businesses and living around the world, then 14 years as the CEO of a public technology company, and now I am so excited to be part of a technology start-up! It is a wonderful chance for me to give back what I have learned in life and business, to help entrepreneurs and start-up companies grow their business.”

Visit: Morpheus Solutions

-

Alkegen (formerly Unifrax) is a global specialty fibers company providing innovative thermal management solutions for a variety of end markets and applications with a proven history of strategic growth through product innovation, market innovation and geographic expansion.

Organizes staffs and controls the Technical and Engineering Departments with focus on oversight of development of new and/or improved products and processes while coordinating the Company's capital expenditures and capital equipment designs for new products and line expansion. Evaluates competitive products and processes, coordinates patent and license functions with various BPA organizations and assists in Health & Safety activities.

Directs and coordinates the preparation of technical elements of the Company's Strategic Operating Plan. Makes recommendations regarding modifications and provides advice and counsel to the management team in the development of such plans. Directs the innovation pipeline and new business development organizations. Provides direction for technical staff by holding regular reviews and operation sessions.

Recruits multi-disciplined talent for technical and engineering functions.

Prepares patent applications for developed products and ensure that patent applications are made for key products. Coordinate other patent and license activities.

Provides technical support on Health & Safety issues (including MSDS and Federal and State regulatory items.) Conducts monthly coaching sessions with direct reports. Seven Direct Reports worldwide in US, UK, Germany, France, Czech Republic, Russia, China, Japan, Korea, and India include: Director Capital Engineering – Engineering, Sr. Director Process Engineering – Engineering, Director Forming and Finishing - R&D, Director Fiberizarion - R&D, Director New Business Development, Director Lab Services and Applications Engineering and Senior Director Platform Technologies.

-

Prior to founding Foresight Capital, Dave was the CFO and EQT, a $15 billion E&P company. Prior to that, Dave was the CFO of CNX. He has executed numerous large acquisitions and spin-offs.

-

Greg started his career at GE as a Finance Executive. He then worked at Cerberus Capital Management as an Operating Executive. He grew an operating company for nearly ten years through M&A before exiting to a larger strategic company. He then returned to Cerberus as a Senior Managing Director.

-

John currently provides advisory and investment services at Red Maple to numerous mid-market companies that are scaling. Prior to that he worked at Wafta where he was instrumental in building a $3 billion real asset platform including leading the sourcing and execution of $800 million in investments.

-

Michael works in the Principal Investment division of Macquaire. He is the Head of the Americas region for the Finance team. He has colleagues in global offices that look at investments in a wide array of industries. Investments are across the capital structure in both credit and equity.

-

Emberline is an independent private equity sponsor focused on mid-market companies. Prior to co-founding Emberline, Chris worked at Jefferies and FBR where he executed over $3 billion of transaction for clients.

-

Alan has extensive experience in M&A, advisory, and capital raising. He has formed SPAC’s, led M&A deals and works with seasoned private equity executives and family offices to fund investments.